At Coinfinity, buying Bitcoin is a simple, fast and secure experience: available around the clock, regardless of location, completely transparent and without spread.

With SmashBuy, you are in control: pay easily and securely by bank transfer or SEPA Instant and benefit from immediate price fixing at the time of your purchase – regardless of how long your transfer takes.

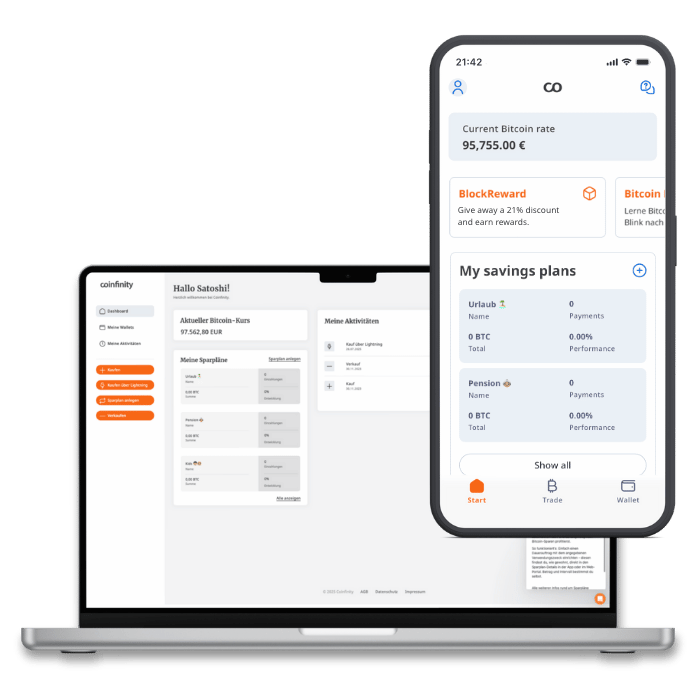

Whether you prefer to use our Coinfinity app or the web portal, our Customer Success Team is available to assist you directly via chat, email and telephone.

The price per Bitcoin is always fixed at the time of purchase – we call this feature SmashBuy.

This means that even if you pay via SEPA-transfer and your payment arrives a few days later, you know exactly which amount of Bitcoin you will receive.

With Coinfinity you can buy Bitcoin via SEPA bank transfer and SEPA Instant.

You need a working internet connection, a valid Bitcoin address / wallet (read more about this here) and a bank account.

If you pay by regular SEPA-transfer, we will send the Bitcoin as soon as we receive the payment on our account, this usually takes 1-2 business days.

When paying with SEPA Instant (real-time transfer), the Bitcoin will be sent after 30 minutes at the latest.

Our service fee is 1.5%. In addition, the usual mining fees apply.

All fees are clearly displayed before your purchase.